This post is the first in a series on our approach to early-stage biotech investing, co-authored by Portal’s venture fellows. We’ve formed our own perspective around market trends and want to highlight bets we’ve made. We hope you enjoy this piece and share our excitement around aging and longevity.

In 1993, Dr. Cynthia Kenyon, a professor at University of California San Francisco made a truly groundbreaking discovery: mutations in a single gene doubled the lifespan of worms. This big discovery in a tiny organism was clear evidence of a claim that almost felt like science fiction, that aging can be artificially modulated. Excitement in subsequent decades has followed about interventions that might be applied to humans to slow or reverse aging. Metformin, rapamycin, nicotinamide riboside, senolytics, and epigenetic reprogramming have all been presented as the next fountain of youth. Unfortunately, worms and mice are not people, and while these approaches are indeed promising, translation to humans has been slow.

Despite decades of research into aging and longevity, we cannot today confidently point to any intervention that will extend healthy human lifespan. As the world population ages, the social and economic burden aging looms even larger. For investors, this raises questions about how we should think about aging and longevity as a therapeutic space.

Is there such a thing as a “good” investment in the aging and longevity space? If so, how can it be identified?

Defining Aging

What is aging, and how do we measure it?

Already, things get complicated. Is age defined by the duration of time since an organism’s birth? Is aging a pathological process or a natural one? This question is so tricky that even scientists can’t seem to agree on an answer (shoutout to Portal venture fellow alums Bri McCoy and Jane Chuprin who co-authored the linked paper). In 2000, Dr. Scott Gilbert, an evolutionary developmental biologist, presented a concise, but clear definition of aging in the textbook Developmental Biology: “the time-related deterioration of the physiological functions necessary for survival and reproduction.” We’ll stick with this definition for simplicity.

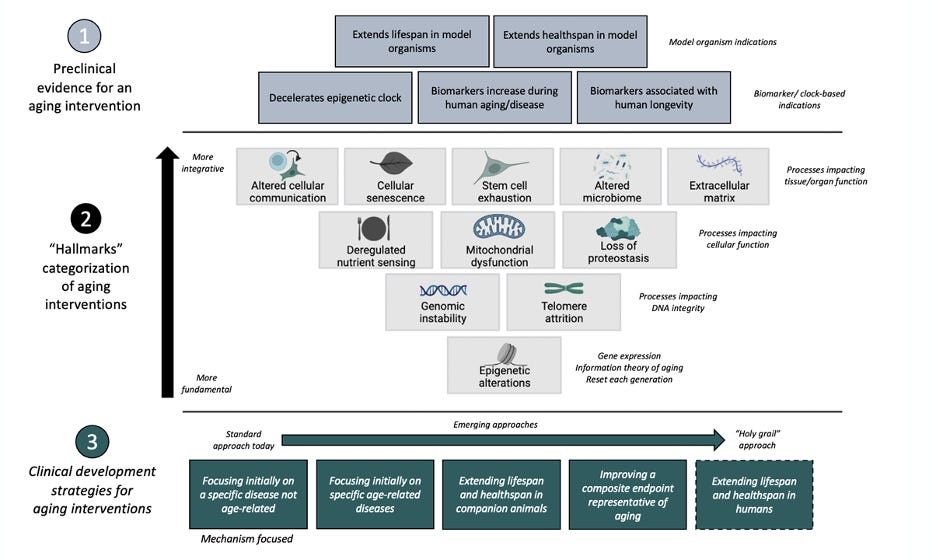

Aging happens on different biological scales and looks different in different parts of the body. In 2013, Dr. Carlos Lopez-Otin, professor of biochemistry, published “The Hallmarks of Aging,” which aimed to identify the hallmarks of aging at the molecular, cellular, and tissue-level scale. He suggested nine common denominators of aging in mammals (highlighted in the figure below). Though there has been debate between experts surrounding these hallmarks, they provide tangible target categories for aging therapeutics.

It's important to recognize that aging itself is distinct from diseases of aging. As early as 400 BC, Plato distinguished between diseases and aging. Dr. Gilbert, the author of our definition of aging, makes a clear distinction between aging and diseases of aging: aging increases the risk of developing certain diseases, though their development is not guaranteed.

Recent debates have arisen around whether we ought to consider aging itself as a disease. Our view is that this question - an important one - is better answered by ethicists than scientists. And for the time being at least, it is a moot one : to treat aging as a disease in any practical sense would require a framework for conducting clinical trials for aging broadly. And the FDA would need to approve drugs on that basis. More on that later.

Diseases of aging are those whose incidence is significantly correlated with age. The list is long, but is largely encompassed by what physician Peter Attia describes as Four Horseman diseases that account for more than 80% of deaths:

Atherosclerotic disease (especially heart attacks and strokes)

Cancer

Neurodegenerative disease (including Alzheimer’s and Parkinson’s)

Metabolic disease (including type 2 diabetes, fatty liver, and many forms of renal and cardiac dysfunction)

Each organ system is impacted by aging in unique ways despite conserved biological hallmarks. Though some diseases of aging do not directly impact lifespan, they almost universally have significant impacts on healthspan, which is the period of time someone is in good health.

Take the brain, for example. The brain displays universal signs of aging, including increased reactive oxygen species and accumulation of damaged proteins. This is aging, not a disease of aging. In contrast, Parkinson’s disease occurs when dopaminergic neurons in a region of the brain called the substantia nigra pars compacta are lost. While the vast majority of Parkinson’s disease cases are associated with aging, and many aging mechanisms are implicated in the disease, not everyone who ages develops Parkinson’s disease. Aging is a risk factor for Parkinson’s disease, but aging and Parkinson’s are distinct.

Investing in Aging and Longevity

This brings us back to our original series of questions. Is there such a thing as a “good” investment in the aging and longevity space? If so, how can it be identified?

Despite the rise of longevity-targeting startups and venture funds, several of which we co-invest with, we believe that there really is no true “aging” company. To succeed in the marketplace, aging-focused startups must eventually focus on specific diseases of aging. This may appear to be a semantic difference, but the distinction is quite important for several reasons.

1. There is no established causal target for aging, while many diseases of aging have clear targets for therapeutic intervention.

While there are clear hallmarks of aging at the cellular and molecular level, the involvement of individual pathways as drivers of aging is still hotly debated. It’s nearly impossible to tease out the causal relationship.

For example, it’s still not clear whether mitochondrial dysfunction is a feature of aging or whether mitochondrial dysfunction accelerates other signs of aging. These questions are incredibly difficult to answer, even with currently available scientific methods, and studies often produce conflicting results. Even when there is clear evidence in model organisms that an intervention extends lifespan and healthspan, questions inevitably remain about whether those findings apply to humans living in the real world.

In contrast, osteoporosis—a single disease of aging that causes the breakdown of bones—is currently treated with bisphosphonates that prevent breakdown by inhibiting osteoclast activity. The disease mechanism and ability to intervene is clear. While aging broadly is difficult to target, a pathway with causal links to a single disease of aging provides a more approachable starting point.

2. There is no clear protocol for aging clinical trials, but many diseases of aging have clear precedents for clinical trials.

Another major hurdle to developing therapeutics for aging is that there is no clear way to design a true “aging” clinical trial. There are no widely accepted biomarkers of aging, so there is no way to test if an intervention effectively slows or reverses it. Aside from a multi-decade trial following thousands of participants through mortality, there is currently no feasible way to test aging. This is in contrast again to osteoporosis, where height change and frequency of fracture over a limited period of time are meaningful clinical endpoints.

3. The American healthcare system is ill-equipped to handle preventative interventions.

Let’s say a small molecule is identified that shows promising pre-clinical lifespan extension in mouse and non-human primate models. Even with this discovery, another hurdle to getting this aging therapeutic into the clinic is that the American healthcare system is currently set up to promote reactive care, rather than preventative care. A treatment to slow or stop aging is inherently a preventative intervention and would likely be difficult to receive patient and physician buy-in and insurance coverage.

We see this playing out now with fights over insurance coverage of GLP-1 drugs for obesity, which have ample clinical evidence of reducing the risks of many diseases of obesity, yet many patients are stuck paying out of pocket. Now, imagine the same fight playing out not just over whether obese Americans should have payer coverage for a certain drug, but for all Americans, even those who are fully healthy by every measure except for their inevitable mortality.

This is not to say that progress in the pursuit of longevity is unattainable. There are many startups working on innovative therapeutics for diseases of aging that could eventually have broad impacts on healthspan and lifespan. But to succeed, they will first need to make a specific impact on a single disease. For Portal to invest, a company needs to offer a compelling value proposition to patients, differentiated from the competitive landscape and backed by data, for a specific disease. We’ve invested in two such companies in the diseases-of-aging space.

Pelagos: Inspiration from Exercise

Everyone knows exercise is one of the best ways to stay healthy, at any age. The molecular underpinnings of why exercise is beneficial are, however, still being worked out. One company Portal has invested in, Pelagos Pharma, is working to harness some of exercises beneficial effects in a therapeutic.

Pelagos (meaning “open sea” in Greek) is developing activators against two proteins, both involved in muscle biology and in aging. The proteins, REV-ERB (pronounced “reverb”) and ERR (for estrogen-related receptor), are part of a larger family of proteins known as nuclear hormone receptors (NHRs). NHRs are transcription factors that turn other genes off and on in response to stimuli. REV-ERB and ERR modulate genes that control how a cell uses energy, typically in response to exercise or other situations of metabolic demand. Both REV-ERB and ERR are highly expressed in organs of high energy demand that are impacted by diseases of aging, like the brain, heart, and skeletal system. And levels of both REV-ERB and ERR appear to decrease with age, meaning that these small molecules activators might also prove useful as a therapeutic for aging broadly.

Nuclear hormone receptors are infamous among pharmacologists as being hard to drug. There aren’t clear binding sites for small molecules, and if you’re lucky enough to find one, it’s hard to find a bioavailable molecule that’s specific to one NRH and not others. One putative REV-ERB activator, SR9009, has actually become popular in bodybuilding communities and is banned by the World Anti-Doping Agency. Whether SR9009 actually works to build muscle is unclear, as it hasn’t been clinically tested and has poor bioavailability. Tom Burris, Bahaa Elgendry, and Lilei Zhang, the scientific founders of Pelagos, have done the hard work of discovering true drug-like molecules that activate REV-ERB and ERR.

We were particularly impressed by the large amount of data the company had generated testing their drug-like molecules in animal models of prevalent diseases with high unmet need, involving muscle biology. One such disease is heart failure, affecting six million Americans, in which the heart muscle cannot pump blood effectively. The other indication the company is pursuing is weight loss with muscle preservation; even with the great success of GLP-1 drugs for obesity, there is concern that they also cause loss of muscle mass. When we evaluated Pelagos, we did not invest in it as an aging company, but as a heart failure and obesity company.

Vincere: Recycling Damaged Mitochondria

Parkinson’s disease (PD) is a neurodegenerative motor disease caused by the loss of dopamine-producing neurons in the midbrain. There are over one million people living with PD in the United States, and there are currently no disease-modifying therapies. That means that while there are drugs to manage the symptoms of the disease, there are no therapies that can slow or reverse the disease progression itself.

In the last decade, mitochondria have come into focus as a likely driver of PD. Mitochondria, famous as the powerhouse of the cell, are organelles that efficiently metabolize glucose to produce usable chemical energy. Dopamine-producing neurons have high energy demands, and when their mitochondria become dysfunctional, these neurons become dysfunctional and eventually die. While more than 90% of PD cases are sporadic, with unknown cause, in the cases where there is a known cause, either a defective gene or a toxin, the causes converge on causing damaged mitochondria. In the sporadic cases, there is also evidence of mitochondrial dysfunction.

Vincere (pronounced vin-chair-ay, Italian for “victory”) is developing inhibitors of a protein called USP30. When USP30 is inhibited, the processes in a cell that clear and recycle damaged mitochondria (known as mitophagy) are enhanced. The idea is that with Vincere’s drug, neurons will better be able to remove damaged mitochondria, and will be able to stay alive and functional for longer.

Vincere’s founders, Spring Behrouz and Andy Lee, first came to appreciate USP30’s role when they built a computational model of a neuron based on genetic and genomic data from patient samples. They went on to engineer several potent drug-like molecule USP30 inhibitors. While there are other companies working on drugging this exciting target, there are good reasons to think that Vincere’s molecules will be more effective and safer. Vincere is also working to drug this same target in renal disease, in which mitochondrial dysfunction also plays a central role.

Many studies show that mitophagy decreases with age, contributing to the “mitochondrial dysfunction” hallmark of aging discussed above. Increasing expression of mitophagy promoting genes in fruit flies also extends their lifespan and healthspan, suggesting a reciprocal relationship. Because of this strong link to aging, we’re excited about the potential for Vincere’s USP30 inhibitors for broader aging contexts. But we invested because we believe that Vincere has a good shot at being successful in Parkinson’s disease.

We think both Pelagos and Vincere are excellent examples of targeting underlying mechanisms tied to aging for diseases of high unmet need. Even though we’ve yet to achieve the elusive goal of robust lifespan extension, companies like Pelagos and Vincere that are targeting mechanisms considered “hallmarks of aging” are leading the charge to get us there by pursuing therapies for specific diseases of aging. We hope their and others’ work will lead to robust improvements healthspan within our lifespans.

Thanks to Dan Watkins, Michele Comerota, Spring Behrouz, and Andy Lee for your contributions and reviews of this article.