Navigating university startup ecosystems

Thanks for subscribing to Perspectives on Innovation Ecology - the quarterly publication from Portal Innovations where we explore biotech innovation with the tools and frameworks of ecology. Every post will come directly to your inbox.

If you missed our first four posts, you can find them here:

The last ten years have been particularly exciting for university-based innovators. As I hinted in my previous post, it has become increasingly clear that if research universities are to succeed at creating real world impact from their discoveries, they need to go beyond the knowledge and technical questions they are used to answering and become capable navigators of product/customer and commercial questions as well.

As with all important realizations, universities realized this “gradually, and then suddenly” with a few institutions slowly leading the way, then going all in, and everyone else following suit. By my reckoning, in just ten years every major research institution has either launched, re-launched, overhauled, or significantly expanded its innovation and entrepreneurship center.

The genesis, design, location within the university, and mandate of these centers differed widely at first. Some focused on students, others on faculty; Some bolted on to an existing tech transfer office; others were built up alongside it, and others were created to replace it outright. Some spun out of a professional school, while others spun out of an academic division. But like all new organizational models (or products or services), what began with a period of experimentation and proliferation eventually converged and consolidated to a more-or-less standard model across universities, at least at the top tier.

The current model for university-supported innovation tends to encompass four main themes: 1) developing & protecting a technology, 2) securing talent, 3) raising capital, and 4) building a business, with support for each spanning from the initial “Aha” moment in the lab or dorm room to the creation, and sometimes early operation, of a company.

Perhaps more interestingly is the emergence of new organizations around the University: new forms of capital, both dilutive and non-dilutive; new organizations to train and match talent; even new types of physical infrastructure. Breakout Labs, CRADL, JLabs, Nucleate, and Portal Innovations typify the depth and diversity of organizations that have evolved over just the last few years to fill important niches in early-stage biotech.

There is a lot happening in early stage ecosystems. Knowing how to navigate them - who to talk to, where to find resources, where not to waste your time - is more complicated than ever.

University Innovation Resources

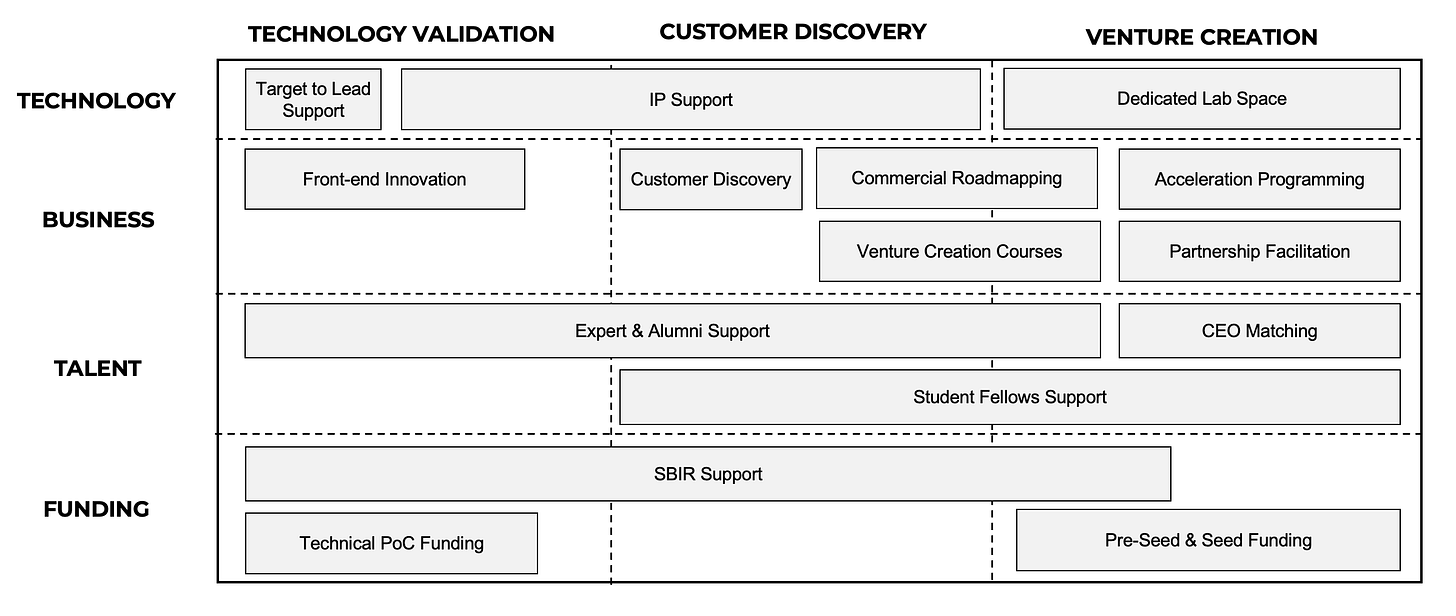

The most helpful way I’ve found to simply visualize these resources is as a 3x4 grid, with “de-risking” stages as columns and activities as rows. The boxes on the grid represent the types of support that one could expect to find in a mature innovation ecosystem, from a combination of universities and other ecosystem players.

1. Technology Validation

A researcher has a hunch - perhaps about the mechanism of a disease and how to modify it with a small molecule, or about how an emerging imaging technology can be applied in the clinic. They design some initial experiments that yield promising data, which point toward a line of inquiry and further experiments. More hands are needed, so a graduate student or postdoc gets involved. Eventually, a collection of data begins to coalesce around a compelling story, and the hunch is transformed into the beginnings of a new technology.

There is a reason that this first stage is often referred to as “the fuzzy front end” of innovation; one can see the outline of something promising emerging on the horizon, but it’s still out of focus. Is it real? Is it a mirage? How big is it, actually? Oh, and how do we get from here to there? Depending on one’s disposition, this is either the most exciting or most harrowing part of the innovation process. It is perplexing and messy. There is no roadmap for how to navigate it. Every decision, from “who is our customer” to “who should be on the team?” is open and ambiguous; The future is a blank slate. What this stage looks like, and how long it takes, varies dramatically from case to case. Thankfully, the goals of this stage, as well as the resources available to achieve them, remain fairly universal.

Goals for the Technology Validation stage:

Conduct “the killer experiment”: What experiment can you perform with a small(ish) budget - think 50 to $150k - whose outcome will either a) kill the idea dead or b) significantly strengthen the case, both to yourself and others, that your approach may actually work. Run that experiment!

Aim to achieve TRL Level 3: TRL stands for Technology Readiness Level, a rubric initially devised by DARPA to measure the maturity of a technology and evaluate it for further investment. For a therapeutic, TRL 3 has been achieved when you have a) identified a target, b) demonstrated in vitro activity, and c) generated preliminary proof-of-concept data in vivo. For a device, it has been achieved when you have demonstrated proof-of-concept with a bench-top prototype.

Submit an Invention Disclosure: By now you should be approaching the point where you have enough data to seek patent protection. Your technology transfer office will have a procedure in place for this, and they will push you to do this before you publish, if at all possible. Listen to them!

Don’t worry about team roles, titles, or splitting up equity just yet. The project is too early for this, and most, if not all, members of the team are part-time, anyway. If someone on your team insists on an equity agreement at this stage, they are probably not a great fit for a risky startup.

Ecosystem Resources for the Technology Validation stage:

SBIR/STTR Support: SBIR & STTRs are non-dilutive grants from US government agencies that serve as a bridge between traditional academic research and market-driven investors. I always suggest that researchers pursue them if they can, and many universities have grant consultants that can help you improve your odds. If you can apply for SBIR funding, you should. The more you can de-risk your technology before seeking private, dilutive capital, the better.

Proof-of-Concept Funding: In addition to SBIRs, many universities have dedicated pools of funds for running killer experiments. Where that funding resides depends on the institution. If you are on good terms with your department or division head that is a great place to start; they often have discretionary funds for these sorts of projects. After that, ask your tech transfer office or innovation center. Either, or both, of these, may have available funding (Cal Tech’s Grubstakes Fund and MIT’s Ignition Grant are good examples). Lasty, if you are in a mature ecosystem, there may be sources of proof-of-concept funding outside of your University. The Chicago Biotech Consortium, for example, provides Catalyst Grants for Chicago scientists to pursue cutting-edge, high-risk/high-reward research. Many ecosystems have similar programs.

Target-to-Lead: If you’re lucky, your institution may offer a program, like a target-to-lead program, that is custom tailored to support you at this stage of your development. Columbia’s BioMedX and Northwestern’s INVOForward are stellar examples. Enrolling in these programs requires a significant commitment of time, but they are usually worth it.

2. Customer Discovery

After achieving technical proof of concept, the next critical questions to ask are “which problem should we try to solve first?” and “who is our customer?” You’ll sometimes hear this referred to as Problem-Solution Fit or Product-Disease Fit (PDF). The reason I say “ask” instead of “answer” is because your goal at this stage should be to generate hypotheses, not to pick a definitive market. Many a startup has sown the seeds of its future demise at precisely this stage, by committing too early to the wrong problem.

The temptation is to reach for a problem that is close at hand. “My mom has an autoinflammatory disease, and my platform might be able to solve that!” “Prof. X’s lab down the hall studies atherosclerosis and my technology seems to work in their models.” These may indeed be great places to start, but you should think about them as exactly that; hypotheses in need of further testing. What sets a great innovator apart from a great researcher is the ability to apply the scientific method not just to their technology, but to their choice of a problem.

Goals for the Customer Discovery stage:

Generate Product-Disease Fit (PDF) Hypotheses: a16z’s primer on how to find Product-Disease Fit (PDF) is the best that I’ve found and needs no comment.

Test your top PDFs via Customer Discovery: Customer discovery is a concept popularized by Steve Blank, the creator of the Lean Startup methodology, that describes a rigorous, scientific-like method to testing PDF hypotheses. In recent years it has been embraced by the NSF and NIH and further refined into the I-Corps program. Blank’s book “Talking to Humans”, is a crash course on the process that you can read in one sitting.

Complete a Target Product Profile (TPP): For therapeutics only. A TPP is a one or two page document, standardized by the FDA, that describes the overall arc and end goals of your drug development program. Forcing yourself to write one now will help you, in the FDA’s words, “begin with the goal in mind.” The goal is not to lock you into a particular path, but to keep your thinking focused and crystal clear. It is a living document that you should revisit often. FDAs primer on TPPs is a must read for any therapeutics innovator.

Build a Competitive Landscape: It’s time to start thinking about your competitors. What sets you apart from them? How might you achieve a sustainable competitive advantage? I’ll often hear innovators claim that “we have no competitors.” If you find yourself thinking that, you aren’t thinking of competition broadly enough. Your competitors aren’t those who do what you do, but those who solve the problem you solve. One way to think about this is to ask “beside my technology, what is the customer’s Next Best Alternative (NBA)?” In biotech, you should make sure to include the standard of care on your list, even if it is “do nothing”. Building a good competitive landscape is more of an art than a science, which we will explore in more depth in future posts. Until then, a few thoughts and questions to ask yourself:

Are there any visuals I can use (e.g. graphical abstract, technical diagram, customer workflow) as the base layer?

What layers or overlays could I add (like on a map) to unlock new insights. For example: what might it evolve into in the medium-term?; where are competitors?; where is the IP?; where are clinical trials?; what might it evolve into in the medium-term?

For inspiration, check out Edward Tufte’s books, which catalog 100s of incredible ecosystem maps. I particularly love Minard's famous chart of Napoleon’s Russian campaign. It’s one of the most strikingly descriptive data visualizations I’ve yet encountered.

Start “dating” potential team members: Finding members for your team is a lot like dating. It takes time, it doesn’t happen overnight, and it doesn’t always work out. The more public your project becomes, the more people will be interested in getting involved or pitching in. There are also a lot of projects - like those listed above - that need to get done. Use these as opportunities (dates) to get to know potential team members. If they do a great job and you like them, take things to the next level.. If they don’t - we’ll, it was only one date. Just like dating, aim to escalate commitment over time, before putting a ring on it.

Ecosystem Resources for the Customer Discovery stage:

Student Fellows Support: University students, especially MBA students and PhD candidates, are the most under-utilized resources at a University. They are often smart, capable, and, most importantly, motivated. And your institution almost certainly has a formalized process to match you with them, whether via classes at the business or engineering school, or extra-curricular programs.

Many MBAs are scientists or engineers looking to try new things and switch careers after spending a few years in the job market. For an MBA student, their return to school is meant to be a time of exploration, and the opportunity to work for a promising early venture is a dream. If it doesn’t work out, it still looks great on a resume when you graduate. And if it does, it could turn into the job of a lifetime.

Like MBAs, many PhDs are also looking to make a career switch, though they may be more circumspect about broadcasting that. Especially as they approach graduation and survey the job market, many PhDs begin to see that the traditional academic career path isn’t what they imagined it to be. And regardless,it may just not be tenable: there simply aren’t enough research professorships available to support even the top-tier of PhDs and postdocs. Working with a startup gives a PhD candidate an opportunity to try something new, pick up some marketable skills, and hedge their bets.

The motivation, capability, and availability of both PhDs and MBAs is highly variable. The I’ve found for utilizing them is a 10x10x1 structure: Ten hours per week for ten weeks on one highly defined project with a clear deliverable. This keeps them focused, ensures that there is something concrete for them to accomplish, and gives both you and them an easy out if there isn’t a fit.

Alumni Support: While student fellows can help you get things done, alumni can help you quickly answer questions, test your PDF hypotheses, and get introductions. A university connection is a great way to gain access to a subject matter expert - an industry exec, established founder, or specialty investor - that may not otherwise take your call. If your university has an alumni directory, learn how to use it! If not, LinkedIn’s alumni search tool can work just as well.

I-Corps: As alluded to above, I-Corps is one of the best tools in your toolbelt at this stage. Every region of the US has a network of I-Corps “sites” and “nodes” which are accessible to innovators across the spectrum of technologies, and which are run multiple times per year. There are two formats: the lighter weight “local” format usually consists of 4, 3-hr sessions taught at a local university and requires you to make 30 interviews; the heavier “national” format is a deeper, 7-week format that requires you to make 100 interviews. You can learn more about the NSF program here, and the NIH program here.

Venture Creation Courses: These vary dramatically from university to university and are usually found in either the engineering school or business school. Some can be a waste of your time, but the good ones are a great way to make focused progress on your project in a highly structured setting. Stanford’s Biodesign, MITs Venture Engineering, and Notre Dame’s ESTEEM curricula are all great examples.

3. Venture Creation

In their excitement to start a company, many first-time entrepreneurs like to skip steps 1 and 2 and jump right into forming a company; What should we name it? What should our titles be? Who gets the most equity?

These aren’t unimportant questions, but they are much less important than validating your technology and customer. Before you begin brainstorming witty names and haggling over equity, go back to stages 1 and 2 and ask yourself: Have we really validated our technology? Have we really identified a compelling product-disease-fit?

Goals for the Venture Creation stage:

Name your baby - Picking a name for your startup may seem trivial. It’s not. Like pushing a boat away from shore, it symbolizes the beginning of a new journey, a level of commitment, and a willingness to take a leap. You are no longer managing a project or developing a technology. You are building a business. Naming your startup shows the world, and yourself, that you are serious about building something.

Incorporate - The typical trigger for incorporating a startup is the need to enter into legal agreements: a lease, a loan, an IP license, an investment, or an employment agreement. This is not the place to get cute or creative; for 99% of biotech startups, a vanilla Delaware C-Corp is the ticket. CooleyGO is a great resource for orienting yourself to the process and the documents you will need.

License Your Technology - This is one of those steps that every entrepreneur dreads, and which can be particularly frustrating if your university rarely spins out companies. Unlike incorporating your business, there are no vanilla licensing agreements. Budget for this process to take ~6 months.

Move out of your academic lab - Many scientific founders are tempted to keep as much of the science in their lab as they can for as long as possible. This can be valuable, even preferable, during the technology validation stage. But there comes a time to cut the umbilical cord. Staying at the university for too long will threaten the life of your startup. A few reasons:

Contract researcher agreements are expensive. Beside the obvious overhead costs (often 50% or greater) are costs of time and attention. Negotiations and administrative red tape will slow down a startup tremendously.

IP ownership can be contentious. The only way to ensure that the patents generated by your research are owned by your startup is to conduct that research in your own lab.

More often than you might think, startups fail when the results generated in their home lab fail to replicate in new hands outside university walls. As such, investors who’ve been around the block tend to take a “trust but verify” to academic data. They will be much more likely to believe you if you’ve replicated your data outside of academia.

Raise some pre-seed funding - This is an involved topic that I’ll likely return to at length in the future. Until then, I’d encourage you to start with Bruce Booth’s Ten Tips on How to Raise Capital in Biotech. These hold just as true now as they did in 2013.

Ecosystem Resources for the Venture Creation stage:

Incorporating: Clerky is a step-by-step online tool that will get you up and running, cheap and quick, but trustworthy. A lawfirm may cost a bit more up front, but is usually a simpler, smarter bet. If you’re lucky, your university may have a resource like UChicago’s Innovation Clinic, that can walk you through the whole process for free.

Licensing: In 2020 a group of academic institutions, VCs, and law firms created the University Startup Basic Outlicensing Template (US-BOLT) to help reduce the time (and money) it takes to license a university technology. This document can help you familiarize yourself with the most common terms in a licensing agreement, and it can serve as a baseline for negotiating with your university.

Gap Funding: Recently launched biotechs can quickly find themselves in a capital “valley of death”. Their technology is too mature and commercially-oriented to qualify for the non-dilutive funding sources (e.g. R-grants) that power the bulk of academic science. But it is not yet sufficiently de-risked to attract venture capital. A few pioneering universities created gap funds to solve this problem, and now most research universities have one. Like the gap that they fill, gap funds resemble grants in some aspects and venture capital in others. Most have a check size of $150 to $500k and use a funding instrument called a SAFE note. Jacob Johnson’s annual Mind the Gap report is the place to go to learn about which universities have gap funds and how they work.

Finding lab space: As recently as 2022, finding lab space was probably the biggest challenge for early-stage biotechs. A recent boom in startup-oriented lab buildouts, led by groups like Portal Innovations, means that lab space is now much more accessible in cities across the US. If you’re an academic spinout looking for lab space, drop us a line.

I find super interesting your 3x4 grid to structure development stages and activities. I think this can be very useful for early conversations with first-time scientific entrepreneurs to discuss what will need to be done, but also when!